Tax Services

The Tax Cuts and Jobs Act of 2017 (TCJA) created the “Opportunity Zones” (OZ) program to encourage private investment in low-income communities throughout the country designated as Qualified Opportunity Zones (QOZ). Fund sponsors, fund investors, real property owners and developers, and businesses potentially benefit by participating in this program.

The OZ program provides federal tax benefits to Qualified Opportunity Fund (QOF) investors. A QOF is an investment vehicle organized as a corporation or a partnership for the purpose of investing in QOZ property. Taxpayers can form and self-certify their own QOF or invest in a professionally managed QOF.

A QOF investor is a taxpayer who reinvests capital gain proceeds from sales or exchanges of property with unrelated persons in a QOF within a defined 180 day period. QOF investors include corporations, partnerships, individuals, and estates and trusts.

The QOF (corporate or partnership entity) has a limited time to reinvest at least 90% of the cash in QOZ property. QOZ property includes QOZ stock, QOZ partnership interest, and QOZ business property. The corporate stock and partnership interest must be acquired solely in exchange for cash after December 31, 2017 (at its original issue in the case of stock), and the underlying business must either be operating as, or is in the process of being organized to operate as a QOZ business. The status as a QOZ business must be maintained for at least 90% of QOF’s holding period of such stock or partnership interest.

QOZ business property is tangible property used in the trade or business of the QOF or QOZ business provided such property was acquired by the QOF or QOZ business after December 31, 2017. The original use of QOZ business property must either begin in the QOZ or the property must be substantially improved.

A QOZ business means:

- (1) at least 50% of the gross income of the business is derived from the active conduct of a trade or business in the OZ,

- (2) at least 40% of the intangible property is used in the active conduct of a trade or business in the OZ,

- (3) less than 5% of the business assets are cash and other nonqualified financial property, and

- (4), the business does not operate a golf course, country club, massage parlor, hot tub facility, suntan facility, racetrack or other gambling facility, or liquor store.

Federal tax benefits:

- The federal tax on capital gains timely invested in a QOF are deferred until the QOF investment is sold or exchanged, or Dec. 31, 2026, whichever is earlier;

- Ten percent of the deferred capital gain is permanently excluded from federal taxable income after holding the QOF investment for 5-years and an additional 5 percent is permanently excluded from federal taxable income after holding the QOF investment for 7-years; and

- Any appreciation in the QOF investment is permanently excluded from federal taxable income when the QOF investment is sold or exchanged after holding the QOF investment for at least 10-years.

The OZ Program has the potential to become one of the nation’s most significant economic development programs.

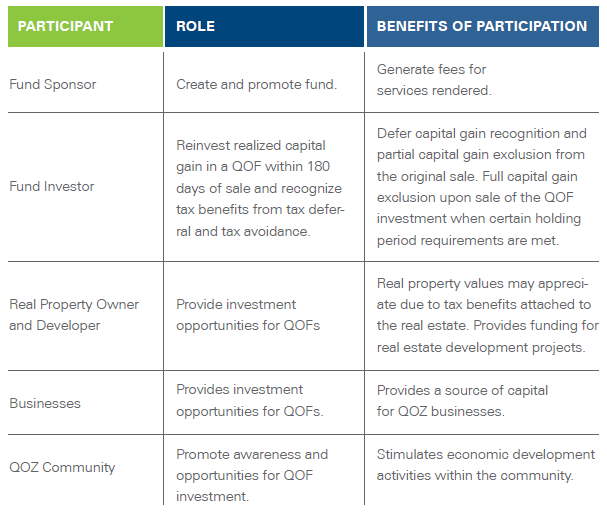

So who benefits? The following chart identifies the participants, the role they serve and the potential benefits for participating in the Opportunity Zones program.

Click here to learn more: https://esd.ny.gov/opportunity-zones

For more information about opportunity zones, contact Don Warrant (don.warrant@freedmaxick.com), Mark Stebbins (mark.stebbins@freedmaxick.com) or Dave Barrett (dave.barrett@freedmaxick.com).